USEC Stock Glows with LEU Sunset Win

On November 13, 2013, U.S. producer USEC prevailed in a sunset case involving low-enriched uranium (LEU) imports from France, keeping antidumping (“AD”) duties in place for at least five more years, with a 3-1 win at the U.S. International Trade Commission. One key issue in this proceeding was USEC’s ability to obtain financing to complete construction of a next generation enrichment facility (the American Centrifuge Project (ACP)), and whether revocation of the order would jeopardize financing.

Practitioners in this field sometimes wonder about the real-world effects of AD or countervailing (“CVD”) duties. Do petitioning companies really benefit from AD/CVD orders? In the LEU sunset case, the effect on USEC’s stock price was immediate and dramatic. The sunset meeting opened at 11:00 a.m. and the vote actually occurred shortly thereafter. As shown in the chart below, USEC stock and trading volume surged starting at about 11:12 a.m. The USEC stock opened the day $6.74/share, and closed at $10.01 / share, for a one-day increase of 49%. The stock receded some the following day, closing at $8.77/share on November 14, but still remained 30% above its pre-ITC determination level. Only time will tell if this increase will be sustained, but clearly the market believed that maintaining duties would provide significant financial benefit to USEC.

As shown in the chart below, USEC stock and trading volume surged starting at about 11:12 a.m. The USEC stock opened the day $6.74/share, and closed at $10.01 / share, a 49% increase.

Figure 1: USEC Stock Reaction to Nov. 13, 2013 LEU ITC Vote

Source: Google Finance

The stock maintained its relative strength, closing at $8.77/share on November 14. Only time will tell if this increase will be sustained, but clearly the market believed that maintaining duties would provide significant financial benefit to USEC.

Such large and immediate changes in stock prices do not always occur, however. The “perfect storm” for such swings include the following features:

· a publicly-traded U.S. petitioning company or companies;

· a significant portion of the company’s total sales are in the U.S. market for the product covered by the AD/CVD investigations;

· imports which are subject to the AD/CVD investigations are significant.

· With respect to the product covered by the investigations there are few substitutes (e.g., similar products, or imports from other countries).

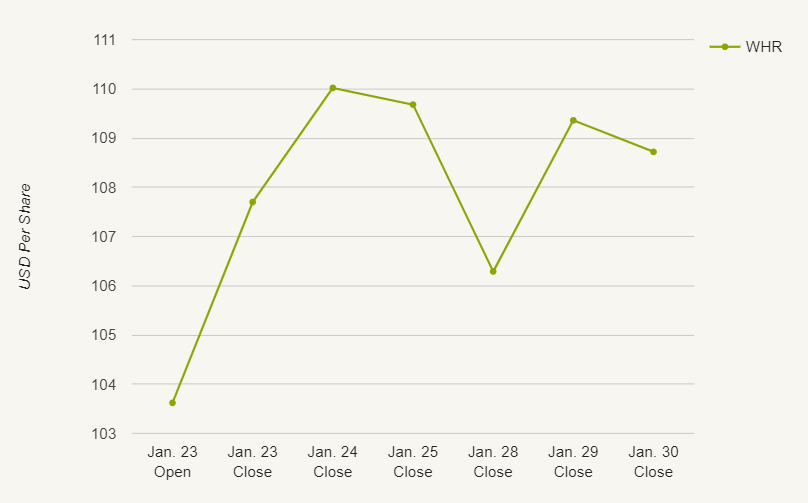

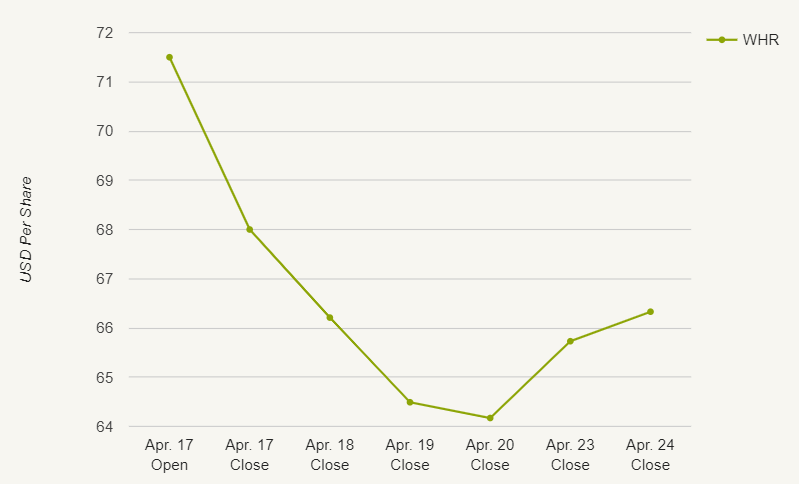

The case against LEU from France certainly fit into this model. An alternative example to consider is that of Whirlpool. Over the past two years Whirlpool has had two cases at the ITC, one involving large residential washers (“LRWs”) from Korea and Mexico and the other involving bottom mount combination refrigerator-freezers (“BMRs”) from Korea and Mexico. According to Whirlpools February 19, 2013 10-K, refrigerators and freezers were 30% of the company’s net sales in 2012 while laundry appliances also accounted for 30% of the company’s net sales in 2012. Furthermore their 10-K states that in 2012 the North American Market made up 52% of the company’s total sales. While Whirlpool does not specify specific product sales within the North American market, it is safe to assume that North American sales of refrigerators and freezers and laundry appliances make up a discernible portion of the company’s overall net sales, however unlike USEC these at issue products are not responsible for majority of the company’s total revenues. As a result it would be expected that the determinations made by the ITC would have an effect but not as large of an effect as seen with USEC. As shown in the table and graphs below this is clearly the case.

**missing table**

Figure 2: Whirlpool Stock Reaction to Jan. 30, 2013 BMR ITC Vote

Source: Yahoo Finance

Figure 3: Whirlpool Stock Reaction to Apr. 17, 2012 LRW ITC Vote

Source: Yahoo Finance

When the ITC voted negative on BMRs Whirlpool’s stock fell 4.9% that day, alternatively, when the ITC voted in the affirmative for LRWs Whirlpools stock increased by 3.9% on the day. These changes are put in greater contrast when considering the movement of the overall market. The day of the BMRs vote, the S&P 500 actually gained 1.5%, making Whirlpools decline even more stark. Alternatively the day of the LRWs vote the S&P 500 remained relatively flat, gaining only 0.2%, thus Whirlpools stock increase on that day cannot be attributed to overall market trends. Finally looking at stock prices one week after the votes shows that the changes were sustained in these cases. Specifically for BMRs one week later Whirlpools stock remained down 7.2% while for LRWs the stock prices remained up 4.9% one week later.